The basics of home loans

A mortgage is essentially a loan used to purchase real estate, typically a home. Instead of paying the full price upfront, you borrow money from a lender (like a bank or credit union) and agree to pay it back over a set period (the term), usually 15 or 30 years, with interest. The property itself serves as collateral for the loan, meaning if you fail to make payments, the lender can take possession of the home through foreclosure.

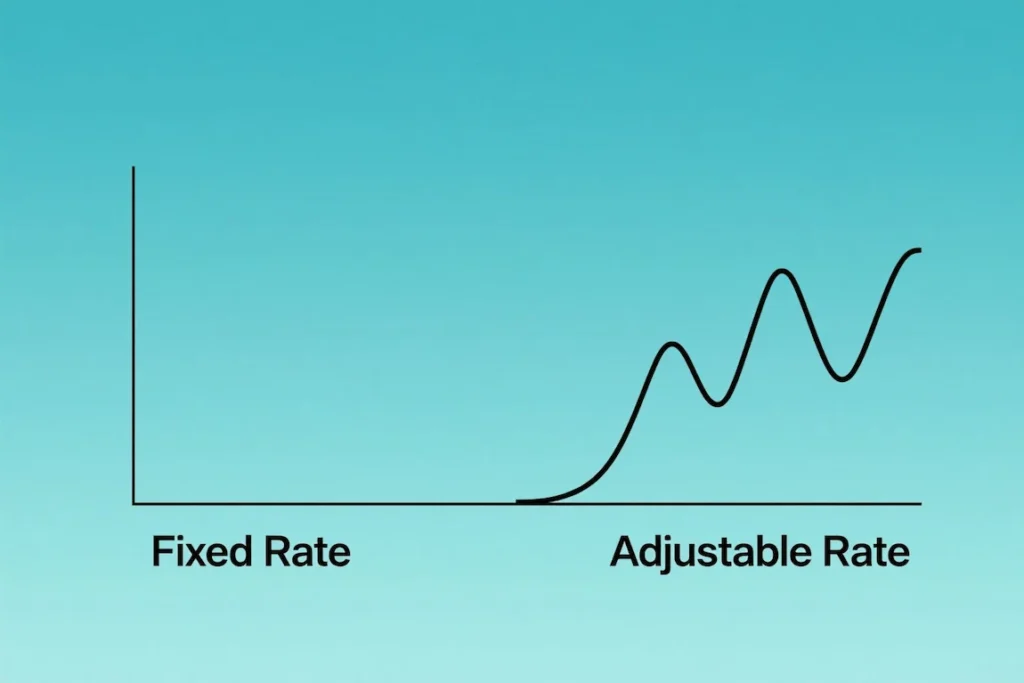

Fixed vs. adjustable rates and more

Mortgages come in various types. The most common distinction is between Fixed-Rate Mortgages (FRMs), where the interest rate remains the same for the entire loan term, providing predictable payments, and Adjustable-Rate Mortgages (ARMs), where the interest rate is fixed for an initial period then fluctuates based on market conditions. Other options include government-backed loans (FHA, VA, USDA) which may have specific eligibility requirements and benefits.

Knowing your buying power: The pre-approval process

Getting pre-approved for a mortgage is a crucial early step in the home-buying process. It involves submitting financial documentation (pay stubs, tax returns, bank statements) to a lender who then verifies your creditworthiness and determines the maximum loan amount you qualify for. This gives you a realistic budget and demonstrates to sellers that you are a serious buyer capable of securing financing.

Factors affecting your rate

Several factors influence the interest rate you’ll be offered on a mortgage. Your credit score is paramount – higher scores generally qualify for lower rates. The size of your down payment also matters; a larger down payment often results in a better rate. Lenders also consider your debt-to-income ratio (DTI) and the overall economic environment, including current market interest rates.